We invest in visionary companies at the forefront of the industrial, construction, logistics, equipment rental, prop-tech, and construction-tech sectors.

Investment Criteria

Pre-Investment

- Superior unit economics

- Strong operating team

- Niche and subject matter expert

- Strong cash-flowing assets with growth opportunity

- VC: Target Size

$1m-$5m in revenue. Product Market Fit & Early Adopters - PE: Target Size

$5-$50 million in revenues and >$1 million in EBITDA

Post-Investment

- Add network partners to accelerate growth

- Add value & growth through: Strategy, packaging & brand, new vertical expansion, acquisition, & operation support.

- Invest across capital structure as a majority or minority investor: common equity, preferred equity, subordinated debt.

- Target hold 4-8 years

Private Equity Platform

Investing and Partnering with Management Teams and Sponsors

Strategic Co-Invest Partners

Team, Positioning, Packaging for Scale

High Barrier Customer Introductions

Acquisition / New Vertical Strategies

Case Study

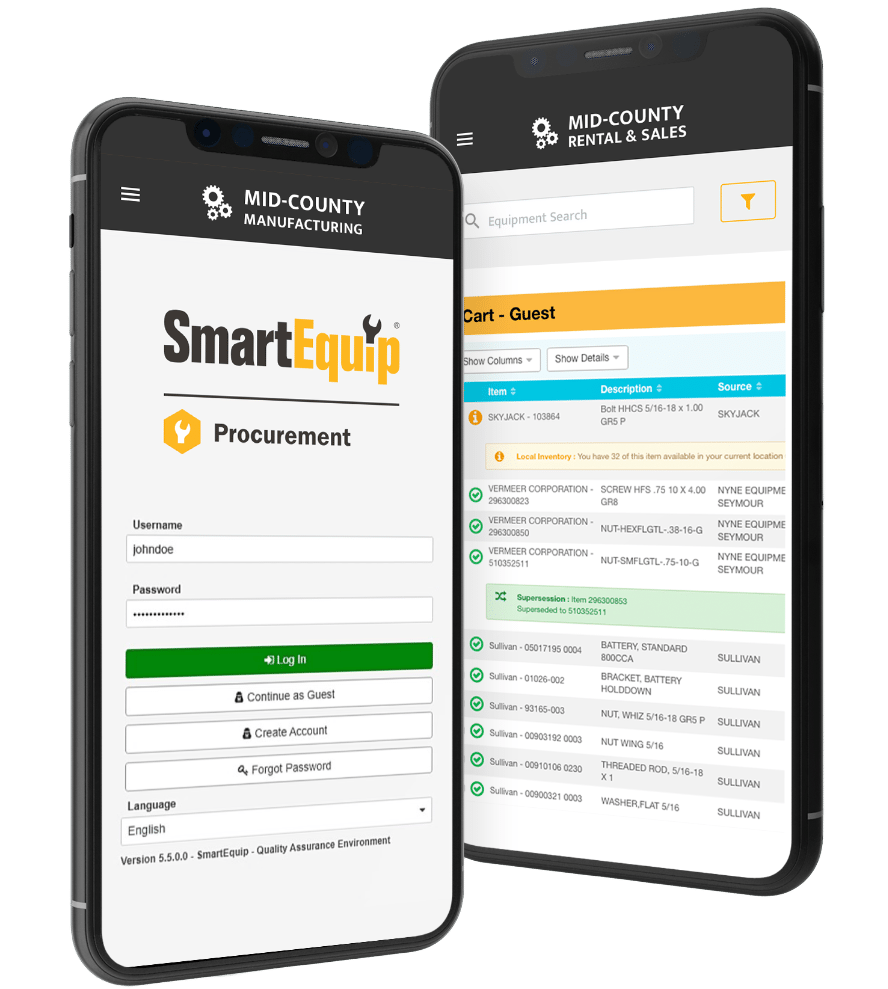

Smart Equip

SmartEquip Inc., a SaaS software network located in Norwalk, CT which operates a procurement network channel delivering web based equipment lifecycle support for more than 600 construction equipment brands and suppliers, to 40,000+ users across more than 6,000 locations in North America, Europe and Asia.

- Replaced and re-assembled a new senior management team

- Co-led the investment group to recapitalize the company

- Transformed the platform from a software shop to a Hybrid SaaS Network

- Team grew the network from 30 to 600 brands

- Achieved 100% customer retention

Note: Investment was made by management prior to the formation of Legacy Capital Ventures.

Self Storage Development Group

SSG is a real estate development and construction company that sourced, permitted and built Class A self storage facilities along the urban core east coast - from Boston to Florida. SSG sold their assets in a hybrid “build to suit” program at certificate of occupancy, creating an efficient pipeline of strong risk-adjusted ROI projects. SSG identified difficult urban core properties, manages the entitlement and permit process and creates additional value with outparcel when available.

- 11 Years in Business

- 15 Properties Developed

- 1.5m + Sq.ft Developed

- 4 Outparcels Generated

Note: Investment was made by management prior to the formation of Legacy Capital Ventures.

Equipment Rental Assets

Utilizing our industry knowledge, network and understanding the growth needs in the Northeast market. We built two new locations (Hyde Park and Woburn) in addition to the existing investment properties in Shrewsbury, MA. Both opportunities allowed to repurpose segmented and under utilized real estate and revitalize it to its highest and best use with AAA credit tenant, Sunbelt Rentals.

- 4 Locations

- 90k Sq.Ft Developed

- Most recently valued ~4% Cap Rate for location and market.

Note: Investment was made by management prior to the formation of Legacy Capital Ventures.